- The Money Trails

- Posts

- Why Tariffs Are Finally Hitting Americans at Home

Why Tariffs Are Finally Hitting Americans at Home

What started as a promise to make foreign countries pay has become a hidden tax on American families

|  |  |

What’s in This Week’s Issue…

Good morning. When Trump promised tariffs would make America rich, he painted a simple picture: foreign countries would pay, American coffers would fill, and jobs would return.

But four months later, the math tells a different story.

American households are now paying an extra $3,800 per year because of tariffs, and small businesses across the country are either absorbing crushing costs or passing them to customers who can barely afford it.

So this week…

🏆 The Big Play: Why tariffs are finally hitting Americans at home and how the bill always comes due

💪 The Power Move: How you can protect your wallet from trade wars

💵 Follow the Money: How Mexico used cartel leaders to thwart U.S. Tariffs

-GEN

🏆 The Big Play

The biggest money power story of the week.

How Trump's Tariff Promise Became America's Hidden Tax

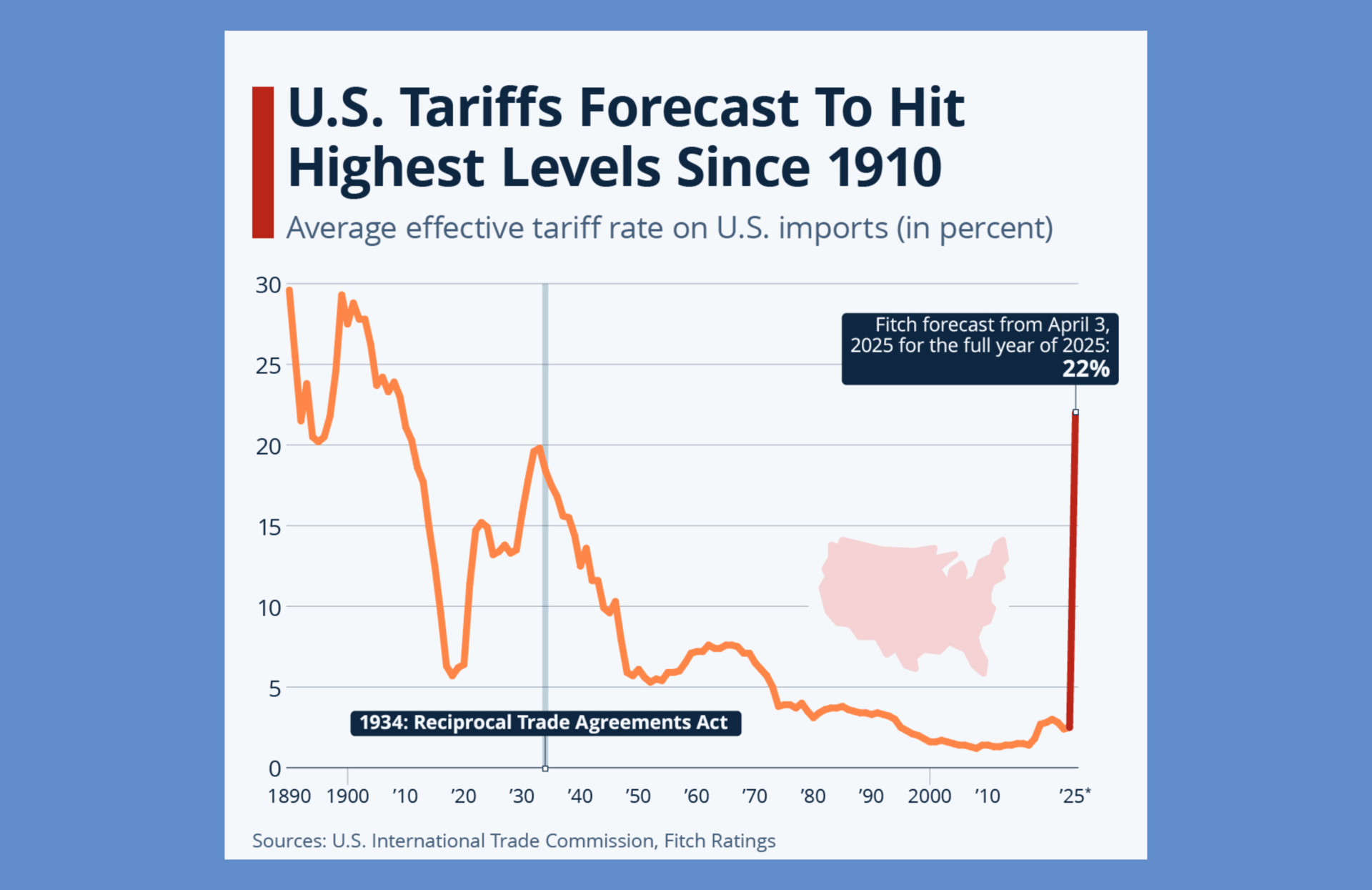

The average tariff rate for 2025 is the highest since 1934

Here’s what tariffs were promised to do:

Make foreign countries pay for cheating America, bring manufacturing jobs home, and fill government coffers, all without costing Americans a dime.

But promises and economics rarely align. And after just a few months of the most aggressive tariff policy since the 1930s, the hidden costs are no longer hidden.

They're showing up in grocery stores, bike shops, beauty salons, and small businesses across America.

This is the story of how tariffs became an economic reality:

1. The Inventory Illusion: Why the Pain Took Time

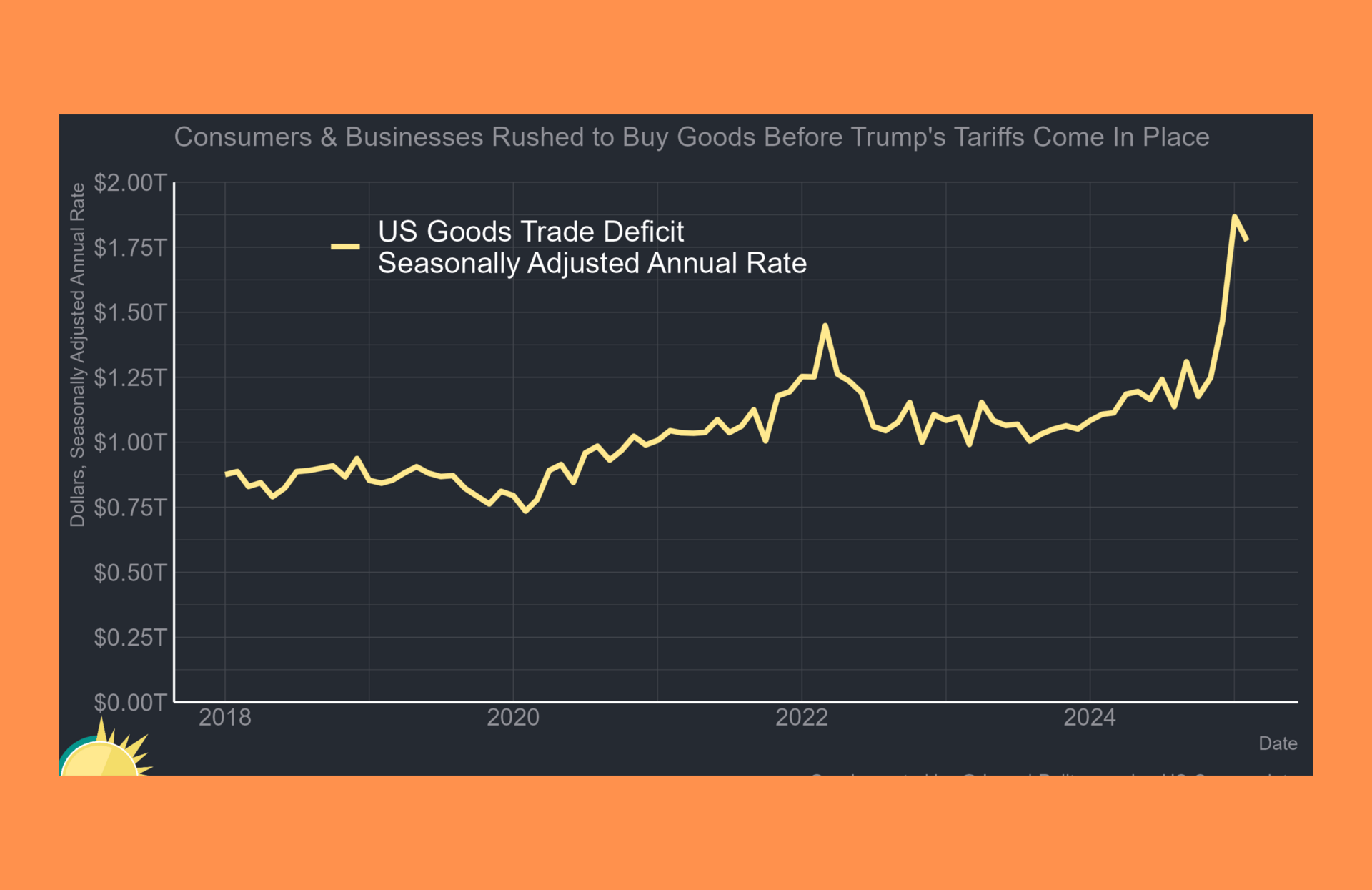

When tariffs were announced, something unexpected happened: importers sprinted to beat the deadline, creating what economists call the 'inventory effect':

Containers of goods, from mid-range bicycles to salon hair dryers, landed at U.S. ports before the new rates kicked in.

Retailers sold from these pre-tariff stockpiles, keeping prices stable while headlines proclaimed minimal inflation.

Imports spiked right before tariffs kicked in to create “inventory effect”

This inventory effect created a temporary buffer that delayed the inevitable price increases.

For example, Nintendo shipped 400,000 consoles ahead of a 46% tariff, several apparel chains crammed warehouses, and even small businesses held back price increases to protect customers.

But buffers don’t last forever. And once they’re gone, there’s nothing left to cushion the blow.

2. When the Bill Finally Reaches Main Street

Small businesses across America have become unwilling transmission belts for a trade war they never chose.

These businesses employ 46% of American workers and contribute 44% of GDP. When they hurt, the entire economy feels it.

And right now, they're caught in an impossible squeeze:

Take the bicycle industry: Bikes and bike parts from China now face combined tariffs of up to 66%, which includes 11% base duty, 25% Section 301 tariffs, 20% fentanyl-related tariffs, and 10% reciprocal rates.

So, a bike that sold for $730 before tariffs now costs $800.

Or consider beauty supply stores, where 80% of inventory typically comes from China:

Hair dryers that retailed for $65.99 now sell for $95.99. Even simple accessories like fashion earrings jumped from $5.49 to $7.49.

The appliance sector tells the same story:

Wine refrigerators that cost $1,499 now sell for $1,999.

Even American-made refrigerators saw price increases of 4-6% because they use steel and aluminum that are now subject to tariffs.

These businesses face a brutal choice: absorb costs that threaten their survival, or pass them to customers who are already stretched thin.

Most are choosing survival. And that means American consumers are finally paying the real price of the trade war.

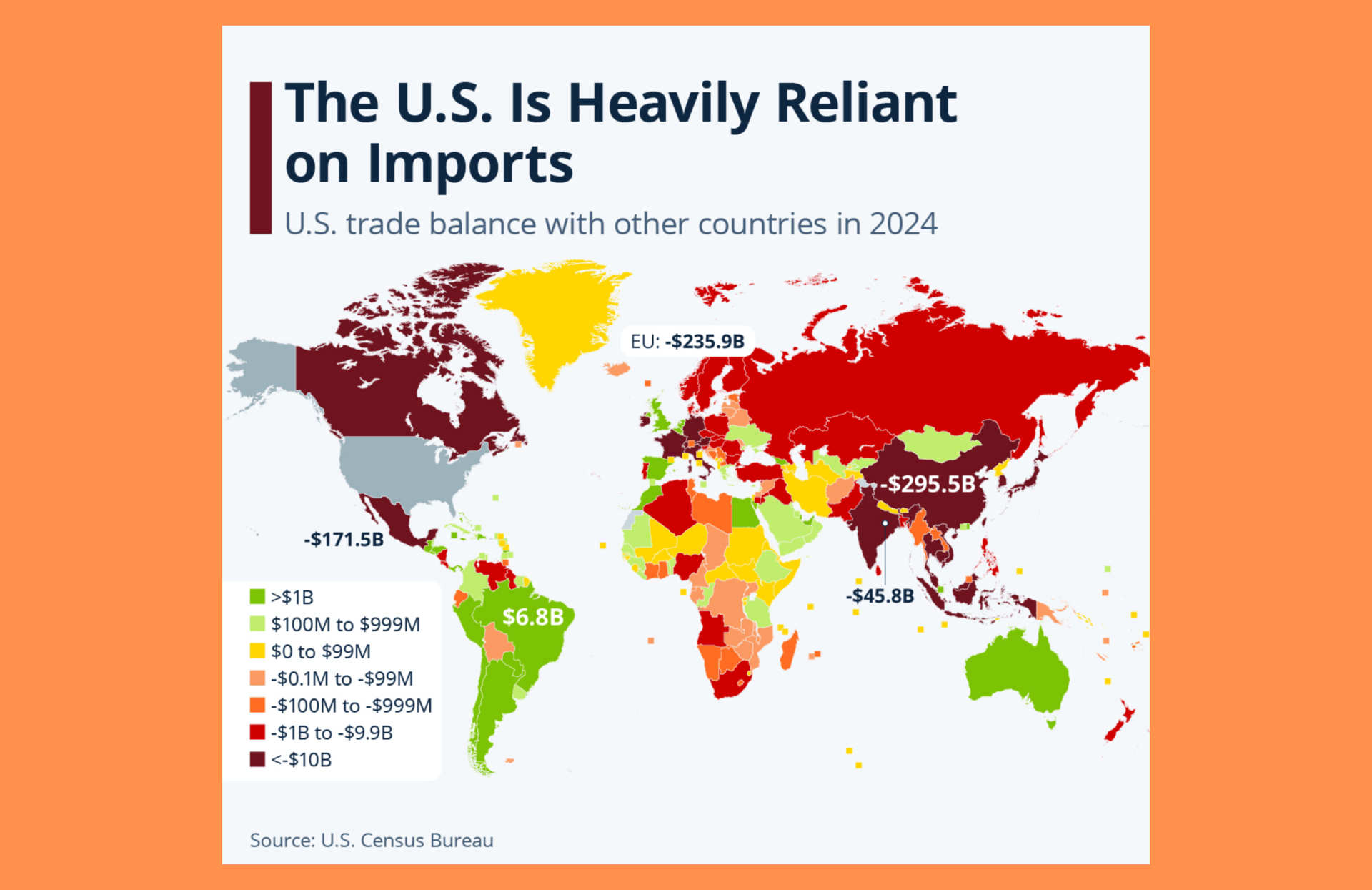

U.S. reliance on imports

3. The Revenue Mirage: Who Really Pays

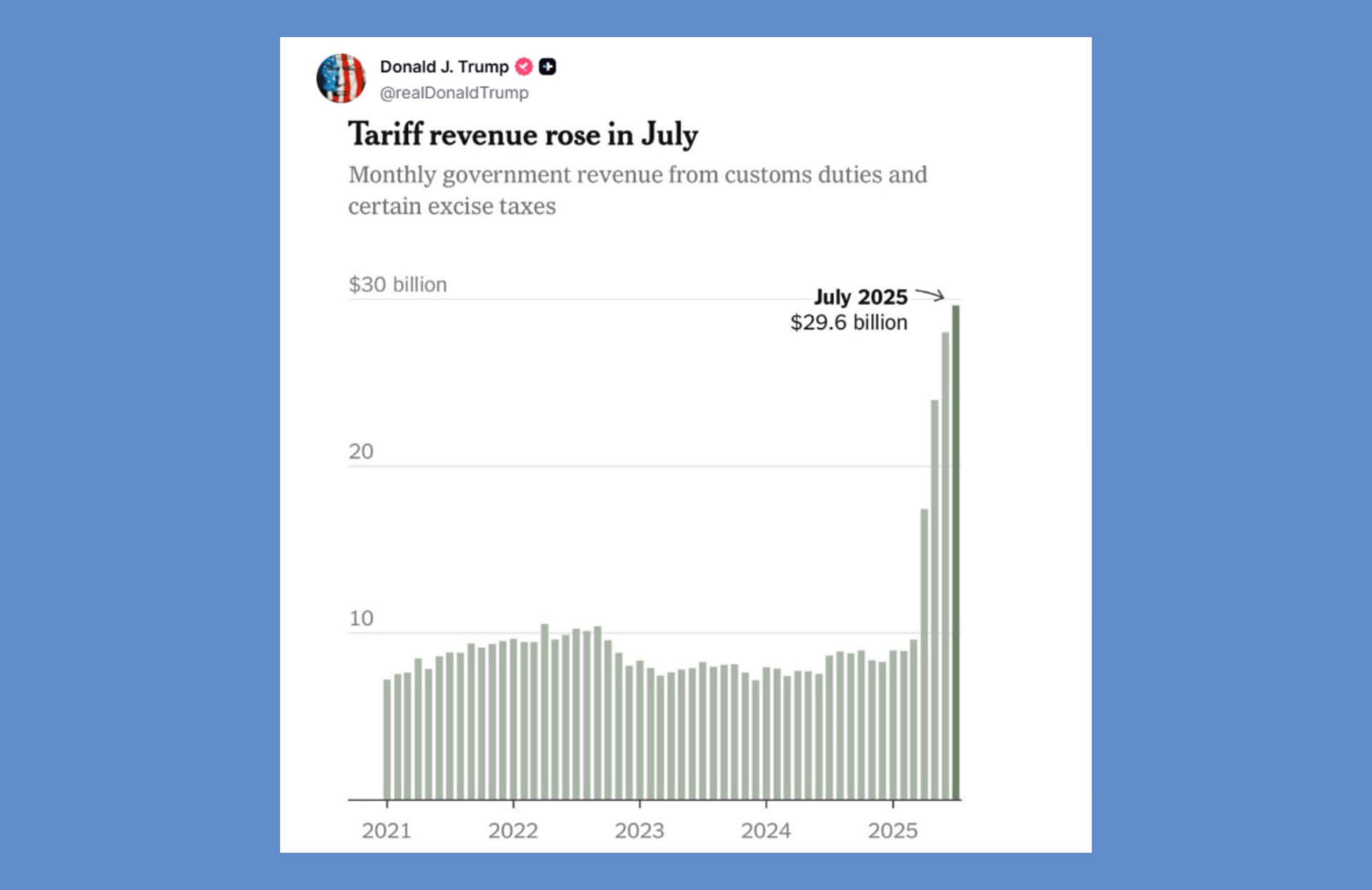

Trump loves to celebrate tariff revenue as proof that his policy works.

And the numbers are impressive by the way: the U.S. Treasury collected nearly $30 billion in July 2025 alone, a 242% increase from the previous year.

But here's the part Trump doesn't mention: every single dollar of that revenue comes from American pockets.

Despite repeated claims that "China pays the tariffs," the economic mechanics are simple:

U.S. importers pay tariffs to U.S. Customs and Border Protection → Those costs flow through supply chains and land on American consumers.

And the math is brutal:

Annual tariff revenue: approximately $360 billion at current rates

Annual consumer burden: $494 billion (130 million households × $3,800 average cost)

So, for every $1 the government collects, American families pay $1.40 in higher costs.

This isn't just bad economics.

It's a wealth transfer from American families to American politicians who can claim they're "fighting for workers" while those same workers pay the bill.

💪 The Power Moves

Playbook for understanding the game of power.

How You Can Protect Your Wallet From Trade Wars

U.S. Tariff Revenue

The tariff story reveals something fundamental about political power:

The gap between what politicians promise and what economics delivers is where ordinary people get caught.

But here’s what you can do: stop treating tariffs as a distant policy battle. Treat them like any other direct cost in your budget, and adjust spending plans when trade tensions spike because prices will follow.

The Takeaway:

In a trade war, the winners are the politicians who sell the story. The losers are always the ones who believed it.

So, don’t be on the losing side of the equation.

💵 Following the Money

Three of the wildest financial and corruption stories from around the world.

President Claudia Sheinbaum of Mexico said last week, “The United States is not going to come to Mexico with the military. We cooperate, we collaborate, but there is not going to be an invasion.”

✨ Poll time!

Who do you think bears the biggest burden from Trump's tariffs? |