- The Money Trails

- Posts

- How Private Equity Will Break America (Like 2008)

How Private Equity Will Break America (Like 2008)

The biggest THREAT to the U.S. economy may no longer be banks, but what replaced them.

|  |  |

What’s in This Week’s Issue…

Good morning. Banks used to be the beating heart of America’s financial system.

But over the last decade, a quiet power shift has taken place on Wall Street.

The new financial titans don’t take deposits, they don’t issue credit cards. And most Americans have never heard of them.

Yet they now control more money, more leverage, and more influence than the banks that nearly collapsed the global economy in 2008.

So this week…

🏆 The Big Play: How private equity and hedge funds are replacing banks

💪 The Power Move: Why the new financial order is more fragile than it looks

💵 Follow the Money: What happens when PornHub pulls out of a country

-GEN

🏆 The Big Play

The biggest money power story of the week.

How Private Equity Quietly Replaced the Banking System

Three of the largest PE firms

After the 2008 financial crisis, regulators cracked down on banks.

They made them hold more capital, subjected them to annual stress tests, and clamped down on risky lending.

Regulators wanted to make the system safer. And for a while, it looked like they had.

But while banks were being reined in, a new breed of financial giants was quietly rising:

Private equity firms like Blackstone and Apollo, Hedge funds like Citadel and Millennium, and Asset managers like BlackRock.

These new giants don’t operate like banks. But today, they do many of the things banks used to do, often in riskier, less regulated ways.

So, how did this happen?

1. The Rise of the Shadow Bankers

When regulators tightened the screws on traditional lenders after 2008, credit didn’t disappear, it simply shifted.

To firms that weren’t technically banks, firms that weren’t weighed down by compliance rules or deposit insurance, and firms that could lend, trade, and take risks more freely.

The result was a shift of power from institutions that were publicly supervised to those that weren’t.

Consider this:

Private credit lending by non-bank firms has exploded to $1.7 trillion, up from $500 billion a decade ago

Hedge fund borrowing from banks has soared to over $1.4 trillion

Banks themselves now lend over $1.2 trillion to non-bank financial institutions, financing the very firms that replaced them

The entire system has quietly morphed into something new:

Banks provide the capital. Private equity and hedge funds take the risks. And retail investors, through new high-yield ETFs and alternative funds, are increasingly exposed to these channels.

I have investigated more about how private equity firms really work in my latest video:

So, what you’re seeing isn’t a return to 2008. It’s an evolution of it.

And it’s happening fast.

2. The New Infrastructure of Financial Power

Ten years ago, Blackstone was best known as a buyout shop. Citadel was a trading powerhouse. And Apollo was a lender of last resort.

Today, they operate more like sovereign wealth funds.

These firms don’t just manage capital. They shape the flow of capital. They fund data centers, buy ports, underwrite energy deals, and even insure life policies.

And they do it all without the same rules, oversight, or transparency that banks are subjected to.

Take Blackstone. It now manages over $1 trillion. It owns everything from warehouses and real estate to private lending platforms and insurance firms.

Or look at Jane Street, a trading firm that made as much revenue as some of the largest Wall Street banks last year.

These firms are no longer playing on Wall Street. They are Wall Street.

And that means the boundaries that once kept risk contained between banks and non-banks, public and private markets, retail and institutional investors, have collapsed.

The result?

We now have a system that’s faster, more innovative, but also more complex, more opaque, and potentially more dangerous.

And all of this is colliding with the chaos of the moment:

Recent trade policy shocks, like the so-called "Liberation Day" tariffs, sent shockwaves through the markets.

Volatility spiked to levels not seen since 2008, confidence cratered, and the dollar fell. And for days, it looked like pure chaos.

And that was the first real test for this new system. A system that might be efficient in calm times, but deeply fragile under stress.

3. When the Next Crisis Comes, It Won’t Look Like the Last One

But here’s what’s most unsettling:

This new financial order doesn’t just shift where risk lives, it shifts who holds the power.

Banks are accountable to regulators. Private equity firms and hedge funds are not.

And that’s a problem.

Because these firms are not just too big to fail, but also too complex and difficult to regulate. They are too interconnected to isolate, yet too opaque to fully understand.

And they’ve convinced markets they’re safer than banks.

But that assumption hasn’t truly been tested, not in a deep recession, not in a liquidity crunch, not in a sustained geopolitical shock.

So, the weakness this time isn’t just leverage or complexity.

It’s that the institutions managing your retirement, your savings, and your debt no longer look like banks.

But they’re acting like them.

And when the next shock hits, it won’t be the Fed or the FDIC that steps in first.

It’ll be the firms whose names most Americans don’t even know.

💪 The Power Moves

Playbook for understanding the game of power.

How to Read the Next Financial Power Shift Before It Hits You

World’s lagest assest management firms

Wall Street didn’t disappear after 2008. It just changed shape.

And it will keep changing, faster than regulators, slower than fear.

If you want to stay ahead of the game, ask yourself:

→ Who is lending, but isn’t called a bank?

→ Who is trading, but doesn’t show up in public filings?

→ Who is taking risk, but doesn’t report it like others do?

Because the next shock won’t come from the usual suspects. It’ll come from the ones hiding in plain sight.

And if you want to protect your money, your future, and your peace of mind, you have to learn to see power before it hits the headlines.

The Takeaway

This isn’t about whether Blackstone or BlackRock are “good” or “bad.”

It’s about understanding that the structure of finance and who controls it has changed.

And when power shifts silently, that’s when it’s most dangerous.

💵 Following the Money

Three of the wildest financial and corruption stories from around the world.

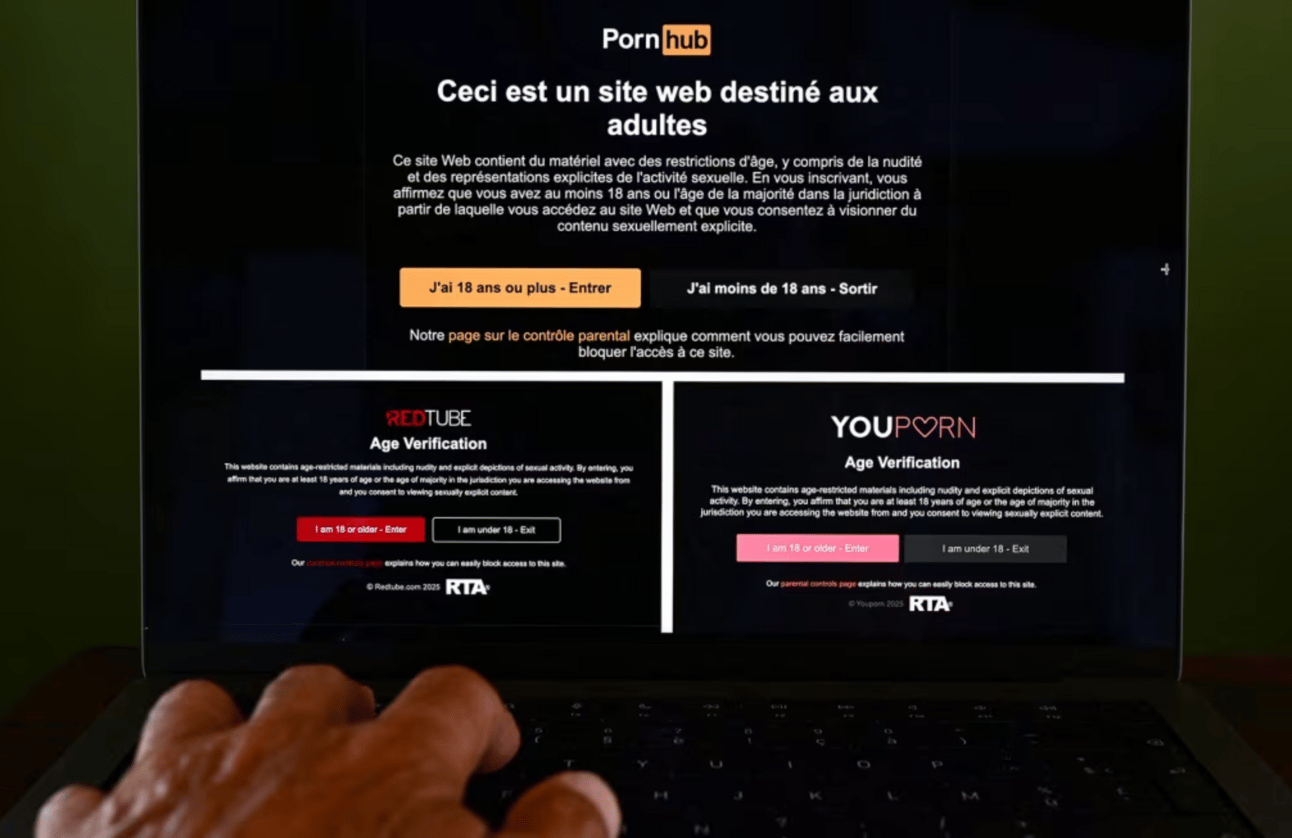

PornHub quits France, its second-biggest market

✨ Poll time!

Do you think financial firms like Blackstone, Citadel, and Apollo should face the same regulations as banks? |